Welcome to Blue Ocean Funds LLC – Your Gateway to Energy Investment Opportunities

Navigating energy investments with innovative capital-raising strategies.

Blue Ocean Funds LLC is a highly seasoned management team, with over $20M in AUM prior to launching Blue Ocean Energy Fund. Leveraging decades of industry expertise with cutting-edge technology to mitigate risks and unlock substantial upside potential across the energy sector.

Dedicated Professionals Ready to Serve You

Our team is committed to excellence.

Hal Abraham Matheson, Chief Executive Officer

Hal Abraham Matheson, Chief Executive Officer

Primarily focusing on the O&G industry, Mr. Matheson is an entrepreneur and seasoned business executive of over 20 years. Upholding a holistic approach, he’s worked in marketing and business development, as well as operations and finance. Today, Mr. Matheson’s network is global and reaches across multiple sectors, including not only energy, but also technology, real estate, and manufacturing. He has also been a licensed real estate broker since 1995. His experience also involves building and maintaining strong relationships with stakeholders, ensuring transparency, and fostering trust in performance and strategic direction.

Dan Gualtieri, Chief Strategy Officer

Dan Gualtieri, Chief Strategy Officer

Mr. Gualtieri is an engineer and energy industry executive of over 30 years. Leveraging his experience, he works in every aspect of the oil and gas industry. He also specializes in corporate strategy, identifying unique market opportunities, new technology commercialization, and fundraising. By staying attuned to market dynamics and customer feedback, Mr. Gualtieri ensures that the Funds’ ability to acquire assets remains competitive and delivers maximum value to our investors.

Geoff Brandt, Chief Operations Officer

Geoff Brandt, Chief Operations Officer

Although a seasoned business professional of over 30 years, Mr. Brandt started leasing land for oil and gas development nearly 40 years ago and is held in high regard for his leadership in building and managing companies that deliver optimal operational and financial results. His experience spans business operations and processes, as well as manufacturing at Fortune 500 firms. Mr. Brandt also has a wealth of experience developing and implementing strategic plans in close collaboration with executive leadership to drive growth objectives. From streamlining processes to managing resources effectively, Mr. Brandt works to create a framework that fosters collaboration and innovation in the Fund’s investment strategies.

Joshua Zuker, Senior Advisor

Joshua Zuker, Senior Advisor

For nearly 25 years, Mr. Zuker has built and operated high-impact technology, real estate, and oil and gas businesses. He specializes in go-to-market strategies, investor relations, and capital financing. As Managing Director of Strategic Growth and Investor Relations of the Investment Manager, Mr. Zuker is entrusted with the paramount responsibility of steering the Fund towards achieving its overarching mission and strategic objectives while maintaining focus on the top line. At the helm of his duties is the formulation and execution of comprehensive business strategies aimed at driving revenue growth and enhancing company valuation. This involves spearheading initiatives to identify new acquisition opportunities. Leveraging his expertise in financial management and strategic planning, Mr. Zuker collaborates closely with executive leadership and key stakeholders to develop long-term financial plans that align with the Company’s growth trajectory and investor expectations.

Harvey Schutzbank, Chief Financial Officer

Harvey Schutzbank, Chief Financial Officer

Mr. Schutzbank has over 40 years of operations, accounting, and financial experience, having served as both a Chief Operating Officer and Chief Financial Officer for numerous consumer products companies. Most recently he was a co-founder and Chief Financial Officer of a personal care company where he handled all aspects of operations, accounting, and financial management. Mr. Schutzbank also has prior experience in the oil trading and oil and gas production industries and is adept at implementing process driven financial controls to maximize financial results as well as financial reporting and building relationships with stakeholders.

Our Unique Investment Approach Sets Us Apart

Tailored Opportunities

Innovative strategies for an ever changing and evolving markets.

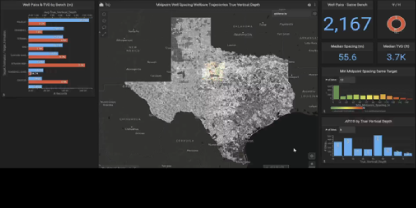

AI Software for Risk Analysis

The fund will deploy advanced AI algorithms to assess, underwrite, and monitor investments in real-time, ensuring that potential risks are identified early and mitigated through predictive analytics.

Technology-Enhanced Production and Operations

The use of AI-powered automation, data analytics, and IoT technology in field operations will streamline asset management, improve decision-making, and boost productivity across the oil & gas and aviation sectors.

Empowering the Future

Smart investments, risk management, and expert guidance, benefitting both the General Partner and Limited Partners.